The 50/30/20 Budget Rule: Your First Step to Financial Freedom

The 50/30/20 budget rule. When the month comes to an end, do you ever question where all of your money went? Most people have trouble tracking down where their paycheck goes, so you’re not alone.

The good news? Making a budget doesn’t have to be difficult. You can take charge of your finances with the 50/30/20 rule by creating a simple, adjustable plan that will increase your savings and reduce your stress.

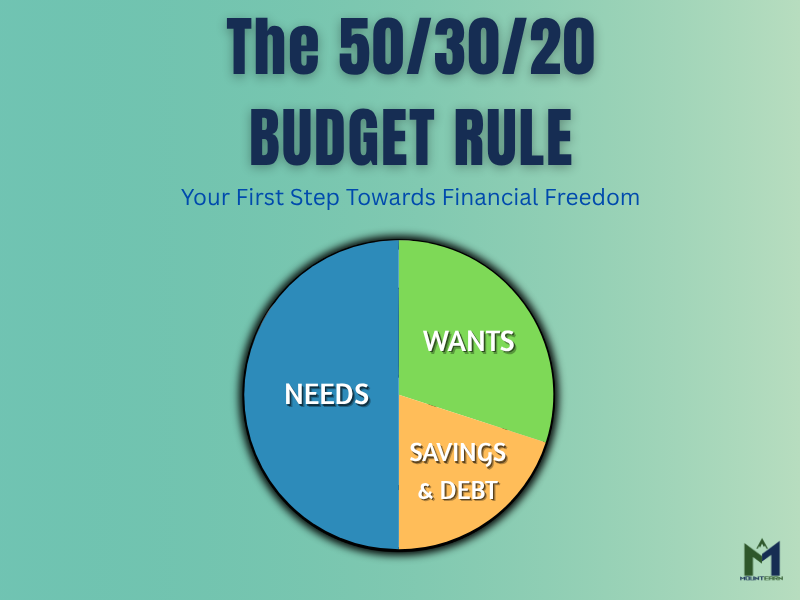

What Is the 50/30/20 Rule?

The 50/30/20 rule is an easy budgeting method that divides your after-tax income into three clear categories:

- 50% for Needs — essential expenses you must pay.

- 30% for Wants — the fun stuff that makes life enjoyable.

- 20% for Savings & Debt Repayment — money for your future.

This simple habits helps you balance living well today and saving for the future.

You can use the 50/30/20 rule more successfully and accomplish your financial objectives more quickly if you have a thorough understanding of each category.

50% for Needs in the 50/30/20 Budget Rule

The things that you cannot live or work without are your “needs.” These expenses are necessary to maintain the smooth operation of your daily life and cannot be negotiated.

Examples include:

- Rent or mortgage payments

- Groceries and utilities

- Insurance premiums

- Transportation (fuel, bus fare, or car payments)

- Minimum loan payments

Don’t let these make up for more than half of your income. Look for ways to reduce expenses if your needs exceed 50%, such as obtaining less expensive insurance or cooking more at home.

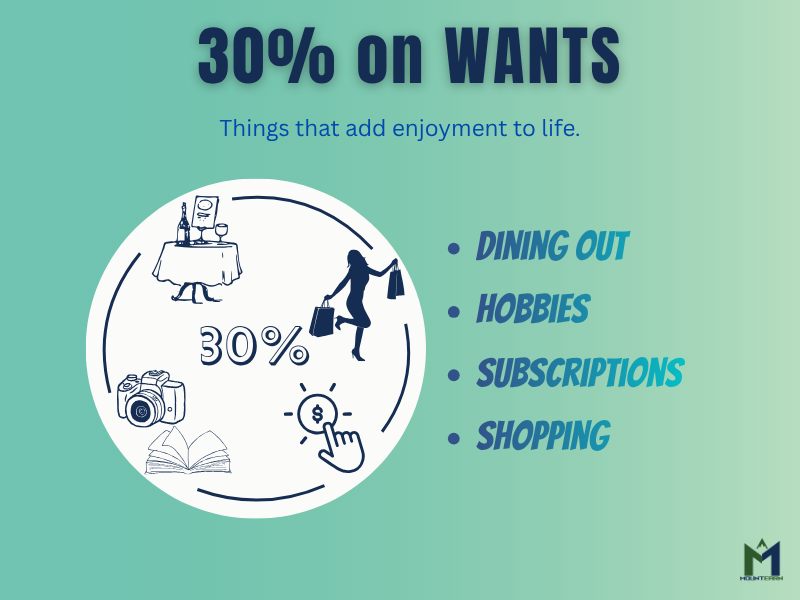

30% for Wants in the 50/30/20 Budget Rule

The things that make life enjoyable but aren’t strictly necessary are your “wants.” Your basic living won’t suffer if you skip them, but they do bring comfort and joy.

Examples:

- Dining out or coffee runs

- Streaming subscriptions

- Shopping and hobbies

- Vacations or entertainment

Keep in mind that limiting your wants can help you save money for bigger things.

20% for Savings & Debt Repayment in the 50/30/20 Budget Rule

Where your financial growth happens here. The 20% portion is dedicated to building a secure future for you.

You can use it for:

- Building an emergency fund

- Paying off credit cards or student loans faster

- Investing in index funds or retirement accounts

Even a small start makes a big difference. Within time, your savings will grow, your debts getting shrink, and your financial freedom expands.

How to Get Started in 4 Simple Steps

Step 1: Calculate Your After-Tax Income

- Your after-tax income is the money you actually take home after taxes.

- Look at your paycheck, bank statement, or pay stub to find this number.

- Example: If your monthly salary is $3,000 and taxes are $500, your after-tax income is $2,500.

Step 2: Track Your Spending

- Keep track of every expense for at least a month.

- You can use:

- Apps like Mint or YNAB

- A simple spreadsheet

- A notebook and pen

- This step shows you where your money is actually going, which is the key to budgeting.

Step 3: Categorize Your Spending

- Divide your spending into the three 50/30/20 categories:

- Needs – essentials like rent, groceries, and bills

- Wants – lifestyle choices like dining out, shopping, hobbies

- Savings/Debt – emergency funds, investments, or paying off debt

- Go through last month’s expenses and assign each item to the correct category.

Step 4: Adjust and Plan

- Compare your actual spending to the 50/30/20 targets:

- 50% for needs

- 30% for wants

- 20% for savings/debt

- If you’re over in one category, look for ways to cut back slightly in that area.

- Set goals for the next month and stick to the plan — even small changes add up.

What If My Numbers Don’t Fit?

“My needs are way over 50%!”

That’s typical; try cutting fixed expenses by cooking more meals at home, switching providers, or moving to a smaller apartment.

“I have a lot of high-interest debt.”

Make debt repayment your top priority by temporarily taking extra money out of your Wants category. Put that money into savings after the debt is paid off.

Conclusion

The 50/30/20 budget rule is a simple, adaptable framework that helps you balance your money. It provides you with freedom to plan for your dreams, clarity, and control.

Are you prepared to assume control? To see how quickly your financial habits change, start by keeping a spending record today.

“Start your financial freedom journey today!