The 20s are a decade of exhilarating firsts: first apartment, first “real” job, maybe even the first taste of true financial independence. But this freedom comes with a hidden hazard—the opportunity to make financial blunders that can haunt you for years.

Think of your 20s as the financial foundation of your entire life. A little extra care now can literally be worth hundreds of thousands of dollars later. Yet, for many, this is the decade where the 7 biggest money mistakes are almost guaranteed to happen.

The good news? If you’re reading this, you can avoid the pitfalls. We’re going to break down the 7 biggest money mistakes 20-somethings make, why they happen, and the simple, actionable steps you can take today to secure your future.

The Financial Foundation Fiasco: Failing to Budget

That’s a fantastic and highly relevant blog post idea! Personal finance content focused on young adults always performs well.

Here is a humanized, SEO-friendly 1000-word draft for your personal finance website, focusing on the keyword “7 biggest money mistakes”.

💸 Stop the Struggle: The 7 Biggest Money Mistakes People Make in Their 20s (And How to Fix Them)

The 20s are a decade of exhilarating firsts: first apartment, first “real” job, maybe even the first taste of true financial independence. But this freedom comes with a hidden hazard—the opportunity to make financial blunders that can haunt you for years.

Think of your 20s as the financial foundation of your entire life. A little extra care now can literally be worth hundreds of thousands of dollars later. Yet, for many, this is the decade where the 7 biggest money mistakes are almost guaranteed to happen.

The good news? If you’re reading this, you can avoid the pitfalls. We’re going to break down the 7 biggest money mistakes 20-somethings make, why they happen, and the simple, actionable steps you can take today to secure your future.

1. The Financial Foundation Fiasco: Failing to Budget

The Mistake:

You’re earning money, but you have no idea where it all goes. You feel rich right after payday and terrified two weeks later. This is often the biggest money mistake—lacking a clear, comprehensive budget.

The Human Truth:

It feels restrictive and boring. Why track every coffee when you’re finally an adult? The truth is, without a budget, you’re flying blind. That $5 latte, multiplied by 20 days a month, is $100 you didn’t even know you were spending.

The Fix:

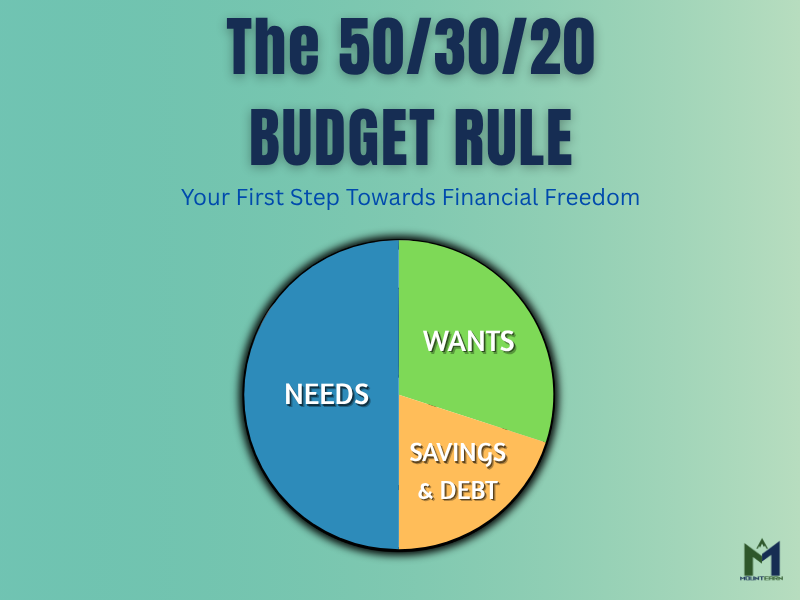

Stop tracking backward and start planning forward. Embrace the 50/30/20 Rule as a simple starting point:

- 50% for Needs (Rent, groceries, utilities).

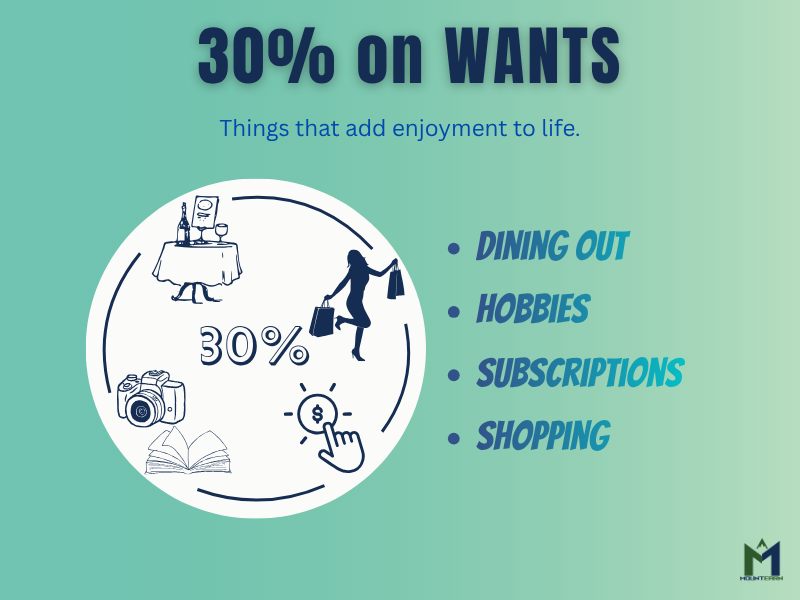

- 30% for Wants (Dining out, entertainment, hobbies).

- 20% for Savings & Debt Repayment (Your future self will thank you!)

🔑 Key Takeaway: A budget isn’t a cage; it’s a map to financial freedom.

2. The High-Interest Habit: Letting Credit Card Debt Spiral

The Mistake:

This is arguably one of the most destructive of the 7 biggest money mistakes. You treat your credit card like an extension of your paycheck, only paying the minimum balance due, and letting the high interest (often 20%+) bury you.

The Human Truth:

In your 20s, it’s easy to fall into the “I deserve it” trap. You feel pressure to keep up with friends or need things now. The minimum payment looks small, making the debt feel manageable until you realize you’re paying more in interest than on the actual item.

The Fix:

- Stop Using the Card: If you can’t pay for it in cash today, don’t buy it on credit.

- Pay More Than the Minimum: Focus on paying down the card with the highest interest rate first (the “Debt Avalanche” method) or the smallest balance first (the “Debt Snowball” method).

🚨 Important Note: Credit cards aren’t inherently evil. Used responsibly—paying the full balance every month—they are powerful tools for building a good credit score.

3. The Employer Match Miss: Ignoring Your 401(k)/Retirement Plan

The Mistake:

When faced with immediate needs, retirement seems impossibly far away. You skip your employer’s 401(k) or matching contribution, effectively turning down free money. This is one of the 7 biggest money mistakes that costs young people the most in the long run.

The Human Truth:

You’re thinking, “I need cash now for rent, not when I’m 65!” But here’s the devastating math:

If you invest $100 a month at age 25, you could have over $260,000 by age 65 (assuming a modest 7% return). If you wait until age 35 to start, you’d only have about $126,000. Waiting ten years cuts your retirement savings by more than half! This is the power of compound interest.

The Fix:

At a minimum, contribute enough to get the full employer match. If your employer matches up to 4%, you must contribute 4%. It is an immediate 100% return on that portion of your investment—you won’t find a better deal anywhere.

4. The Emergency Fund Fail: No Safety Net

The Mistake:

Spending every dollar you earn and having zero money set aside for unexpected costs like a broken-down car, a sudden illness, or job loss.

The Human Truth:

Saving is hard when there are so many fun things to spend money on. But when a financial emergency hits—and it will—without an emergency fund, you’re forced straight back to Mistake #2: the high-interest credit card.

The Fix:

Make saving for an emergency fund your immediate priority after securing your employer match.

- Goal 1 (Starter Fund): Save $1,000 as quickly as possible.

- Goal 2 (Full Fund): Work towards saving 3–6 months of living expenses.

Keep this money in a high-yield savings account (HYSA) where it’s safe, liquid, and earning a little interest.

👉 NerdWallet – What Is a High-Yield Savings Account?

5. The Lifestyle Leap: Rapid-Fire Inflation

The Mistake:

Every time you get a raise or a better-paying job, you immediately upgrade your lifestyle to match. A bigger paycheck means a bigger apartment, a nicer car payment, and more expensive hobbies. This is called lifestyle inflation or lifestyle creep.

The Human Truth:

It’s natural to want to enjoy the fruits of your labor, but if your spending grows at the same rate as your income, you will never feel rich, and you will never build significant wealth.

The Fix:

Practice delayed gratification and the half-raise rule. The next time you get a raise:

- Dedicate at least 50% of the raise to savings, investments, or debt repayment.

- Use the remaining 50% to slightly upgrade your lifestyle. This way, you improve your life while simultaneously accelerating your wealth-building.

6. The College Loan Blind Spot: Treating Debt Like a Background Chore

The Mistake:

Ignoring student loans or just setting up autopay and letting them drag on for decades. While you must pay them, letting them collect interest for 20+ years can double the total cost of your education.

The Human Truth:

Student loans are overwhelming, and it’s easier to pretend they don’t exist. But every day, they accrue interest, slowing your progress toward other goals like buying a house.

The Fix:

- Understand Your Terms: Know your interest rates, minimum payment, and payoff date.

- Prioritize High-Interest Debt: If your student loan interest is higher than your mortgage or car loan, focus on paying it down faster.

- Refinance: Research if refinancing to a lower interest rate is possible and makes sense for your financial situation.

7. The Ignorant Investor: Avoiding the Stock Market

The Mistake:

The 7 biggest money mistakes list is incomplete without this one: being paralyzed by fear and confusion about investing, so you keep all your money in a regular bank account.

The Human Truth:

The stock market sounds complicated, scary, and risky. You worry you don’t know enough to start. Meanwhile, your cash is losing value every year due to inflation.

The Fix:

You don’t need to pick individual stocks to be a successful investor. Keep it simple:

- The Best Place to Start: Max out your tax-advantaged accounts (401(k), Roth IRA, HSA).

- The Easiest Investment: Invest in low-cost, broadly diversified funds like a Total Stock Market Index Fund (e.g., Vanguard Total Stock Market Index Fund) or a Target Date Fund. These investments spread your risk across thousands of companies, require minimal effort, and historically outperform most actively managed funds.

💰 Investing Pro-Tip: Time in the market beats timing the market. Start small, start now.

Final Thoughts: Turn Mistakes into Momentum

The 7 biggest money mistakes people make in their 20s are not permanent failures; they are learning opportunities. Whether you are currently making one, two, or all seven of these mistakes, you have the power to pivot.

The decade of your 20s is about establishing habits. Choose the habits that will build a lifetime of wealth and freedom, not the ones that will keep you running on the financial hamster wheel.

Start with one thing today. Stop the lifestyle creep. Set up that automatic transfer to your savings. Log into your retirement account. Your future self is depending on it.