Needs vs Wants: The Simple Rule That Finally Fixed My Spending

I have a secret: I was a financial fraud. Not a criminal, but a self-deceiver.

I knew the difference between needs vs wants. Ask me on a quiz, and I’d ace it. Food is a need; filet mignon is a want. Easy. But then the paycheck would hit my account, and I’d transform into a self-justifying financial lawyer, arguing my case for every single impulse buy. My bank account, bless its digital heart, was the only thing telling the truth: my theoretical knowledge of needs vs wants was utterly useless against my real-world craving for convenience and immediate gratification.

For years, I’d stare at my transactions—the clothing bought in a rush, the excessive takeout, the gadget upgrades—and feel that familiar, nauseating combination of regret and confusion. I was smart enough to earn money, but seemingly too dumb to keep it. The classic needs vs wants framework was failing me because it was too fuzzy. It allowed too much room for my exhausted, highly-marketed-to brain to say, “Technically, this new espresso machine is a need for productivity and saving money on coffee.” (Spoiler: I still bought coffee out.)

My breakthrough wasn’t a sudden influx of cash or a drastic cut in spending; it was a simple, brutal semantic shift. I replaced the moral judgment of needs vs wants with a lens of pure, objective function. This one rule didn’t just explain the difference; it enforced it, without me having to feel guilty.

The Old Way: The Guilt-Ridden Spending Cycle

Before my revelation, every purchase required exhausting mental Olympics.

- Scenario 1: New Clothes. My old sweater had a tiny stain. “Do I need a new sweater? Yes! It’s cold, and I need to look professional. A stained sweater is a career risk.” (Walks out with three cashmere blend sweaters and a stylish scarf.) The purchase was justified as a need for warmth and professionalism, but the extra two items and the scarf were pure indulgence. The guilt arrived promptly at the end of the month.

- Scenario 2: The Latest Gadget. My tablet was three years old. “Do I need the new one? Yes! My old one is slow, and I need to be efficient for work and relaxation. It’s an investment in my well-being.” I spent a huge chunk of savings. I didn’t get faster. I just had a newer, sleeker version of the old device, and the guilt felt heavier than the tablet itself.

The core issue is that the boundary between a life necessity (shelter) and a comfort preference (a fancy, better-located apartment) dissolves when emotions are high. The continuous juggling of needs and wants caused what economists refer to as “decision exhaustion”, which made it ideal for impulsive purchases and a slow decline of my savings objectives.

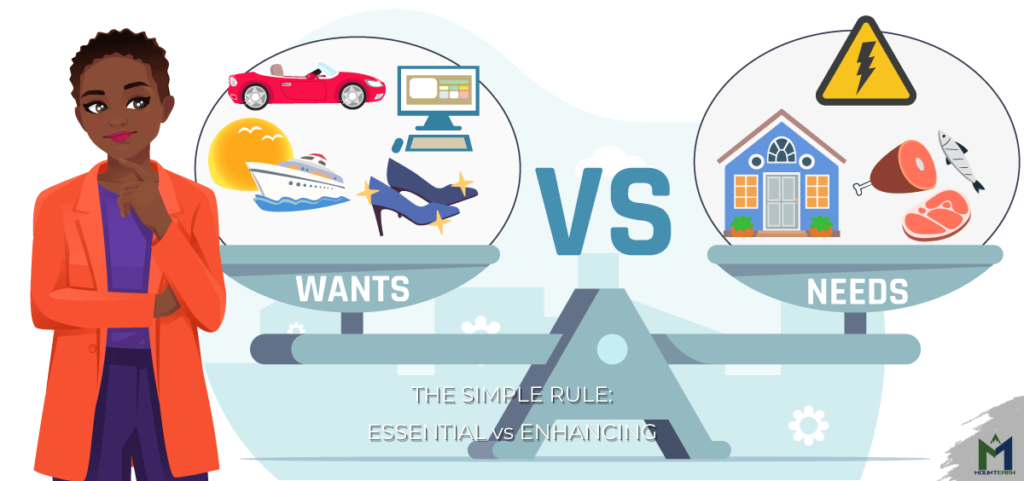

The Simple Rule: Essential vs. Enhancing

The breakthrough came when I stopped trying to force my wants into the “need” box. I threw out the whole box and started asking a question that requires an answer based on cold, hard reality:

“Does this purchase secure my baseline existence and stability, or does it improve the quality of an existence that is already secure?”

I replaced the loaded, emotional terms of needs vs wants with two purely functional, objective categories: Essential and Enhancing.

1. Essential: The Foundation of Life

An Essential purchase is the absolute bedrock. If you remove it, your safety, health, stability, or ability to earn money is in jeopardy. These are non-negotiable payments to keep the ship afloat.

- Shelter: The basic rent/mortgage for a safe, modest dwelling. (Not the extravagant view or the second spare room.)

- Food: Nutritious groceries for basic, sustained meals. (Not the ready-made gourmet dinner kits.)

- Transportation: The most reliable, affordable method to get to your job. (A bus pass, or the maintenance on a functional car.)

- Utilities: Heat, water, and basic connectivity (the minimum internet/phone necessary for work and emergencies).

The key here is survival. Notice how the quality, the brand, and the luxury are instantly stripped out of the definition. Baseline function is the only judge.

2. Enhancing: The Spice of Life

An Enhancing purchase is everything that adds comfort, joy, convenience, speed, or status above that essential foundation.

- Food: Eating out, premium coffee, expensive supplements, organic produce when conventional is adequate.

- Shelter: A cleaning service, home decor, the choice of a luxury apartment building.

- Clothing: Designer brands, clothes bought purely for fashion or excessive quantity.

- Efficiency: The latest phone model when the old one is fine, streaming services, high-end electronics.

- Experiences: Vacations, concerts, expensive hobbies.

Enhancing items are what make life wonderful—they are not the enemy! But by labeling them honestly, I realized they were the flexible part of my budget, the place I could easily draw funds from to meet my actual savings goals.

How This Filter Works in Real Life

Applying the Essential vs. Enhancing rule removes the emotion and forces clarity.

| Purchase Example | Old Thought (Needs vs Wants) | New Thought (Essential vs. Enhancing) | Decision Outcome |

| New Running Shoes | Need. I need to exercise for my health. | Essential. My old shoes are actually causing knee pain and will lead to injury if not replaced. (Focus on preventing damage.) | Buy (Essential) |

| Ordering Takeout | Need. I’m exhausted after work and need to eat. | Enhancing. I have perfectly good food in the fridge. This is for convenience and comfort, not survival. | Limit/Budget (Enhancing) |

| A New $400 Jacket | Need. My old one is out of style, and I need to look presentable. | Enhancing. My current jacket is perfectly warm and functional. This is for status and preference. | Delay/Hold (Enhancing) |

| A New Laptop | Need. My old one is slow; I need efficiency. | Essential/Enhancing Mix. I need a functional computer (Essential). The speed and sleek features are Enhancing. Can I upgrade the ram instead of buying new? | Compromise (Focus on Essential function) |

The Power of Intentional Allocation

This wasn’t about austerity; it was about authority. I didn’t stop spending on the “wants” (Enhancements); I just changed how I paid for them.

- Fund the Essentials First: I pay the bare minimum required for a stable life (plus my key savings goals, which I treat as an Essential payment to my future self).

- Allocate the Enhancements: What’s left over is explicitly my Enhancement budget. It’s my “fun money.”

- No Guilt: When I buy those $400 headphones now, I do it without a shred of guilt. Why? Because I’m paying for it from a budget line specifically created for the joy and improvement of my life, without compromising my foundational needs or my future goals.

This simple reframing of needs vs wants into the clear, objective Essential vs. Enhancing framework changed my life. It took the emotion and the internal debate out of spending and replaced it with clarity and intentionality. It’s the simple rule that finally helped me align my spending with my deepest financial values.

Your Next Step

Grab your last month’s bank statement. Highlight every transaction that was truly Essential for your survival and stability. Everything else is an Enhancement. Look at how much of your money went towards improving your life versus sustaining it.

More Posts

1. The 50/30/20 Budget Rule: Your First Step to Financial Freedom

2. The 7 Biggest Money Mistakes People Make in Their 20s (And How to Fix Them)